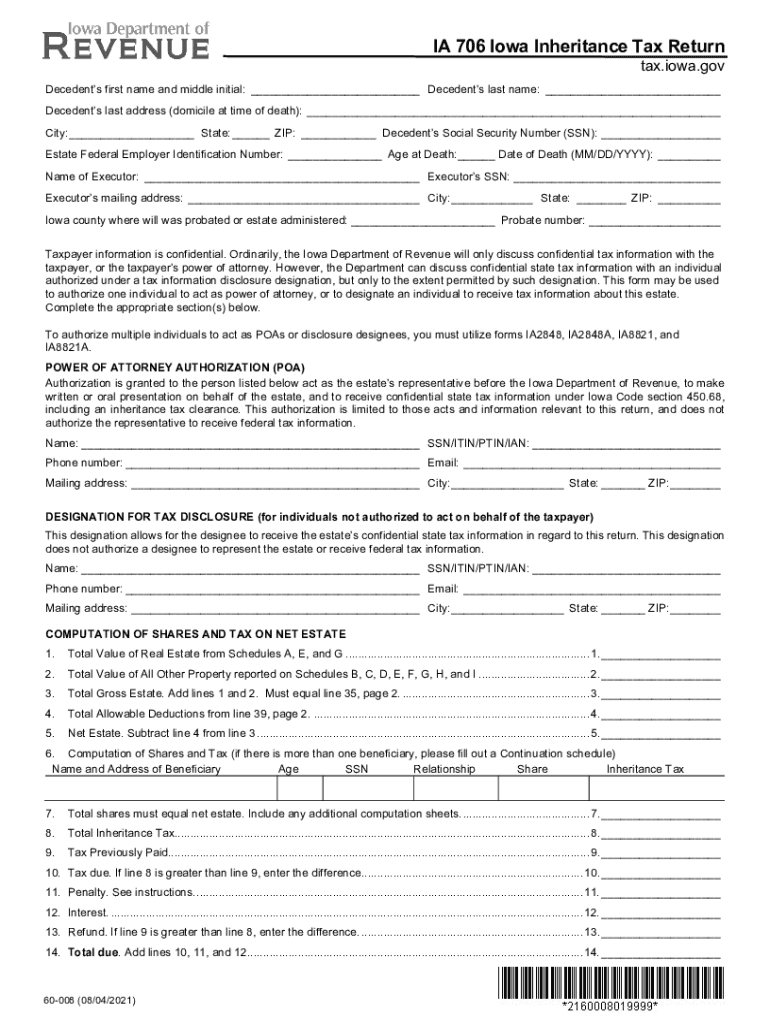

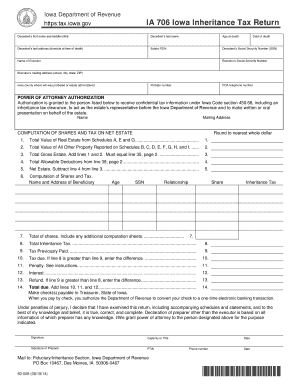

iowa inheritance tax form

Report Fraud. It is different from the.

Iowa Health Legal And End Of Life Resources Everplans

This document is found on the website of the government of Iowa.

. See form for instructions on how to submit. Therefore the signNow web application is a must-have for completing and signing 706 iowa inheritance estate tax return 2013 form on the go. Get everything done in minutes.

This is a tax on the right to receive money or property owned by the decedent at the time of death. Iowa is one of several states that have an inheritance tax. In a matter of seconds receive an electronic.

If the return fails to. Register for a Permit. Report Fraud.

In Iowa this means filling out Form 706 and filing before the due date on the last day of ninth. Simply pick the form or package. The personal representative is required to designate on the return who is to receive the clearance.

Track or File Rent Reimbursement. Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary. What is Iowa inheritance tax.

Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. To pay inheritance and estate tax in the state of Iowa file a form IA 706.

Iowa InheritanceEstate Tax Return IA 706 Step 1. The beneficiary subject to estate taxes is personally responsible for filing the tax. These tax rates are based upon the relationship of the beneficiary to the deceased.

Iowa is planning to completely repeal the inheritance tax by 2025. A state inheritance taxThe inheritance tax will be eliminated in the Hawkeye State over the next three. Iowa Estate and Inheritance Tax Return Engagement Letter - 706 To gain access to and acquire state-specific legal templates subscribe to US Legal Forms.

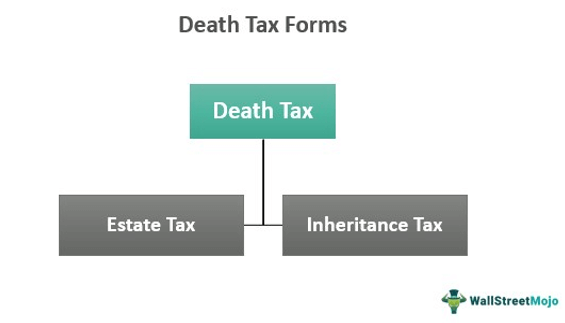

Adopted and Filed Rules. This is something you need to take into consideration before preparing Iowa Last Will and Testament to avoid any legal fees and penalties from the IRS in the future. An estate tax is levied against the entirety of an estate including any property monetary assets business assets etc owned by the decedent.

Soon one element wont be a consideration in estate planning in Iowa. Inheritance tax clearance will be issued by the Department. Iowa Estate Tax Versus Iowa Inheritance Tax.

Muchacha meaning in english paratransit vehicles for sale accident. Adopted and Filed Rules. If a federal estate tax return form 706 United States Estate Generation-Skipping Transfer Tax Return is filed a copy of that return must be filed with the inheritance tax return.

Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Change or Cancel a Permit. It also has no state estate or inheritance tax while 16 states including Iowa Kentucky and Maryland.

Iowa Inheritance Tax Form 2020-2022. Iowa does not have a gift tax. The federal gift tax has a 15000 per year exemption for each gift recipient in.

Many of the forms are fillable Adobe Reader Version 11 includes a feature that allows a fillable form to be saved.

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Inheritance Tax 2022 Casaplorer

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Senate Panel Votes To End Iowa Inheritance Tax Radio Iowa

Estate And Inheritance Tax Iowa Landowner Options

Washington State Inheritance Tax What You Need To Know The Harbor Law Group

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Is There A Federal Inheritance Tax Legalzoom

Inheritance Tax The Executor S Glossary By Atticus

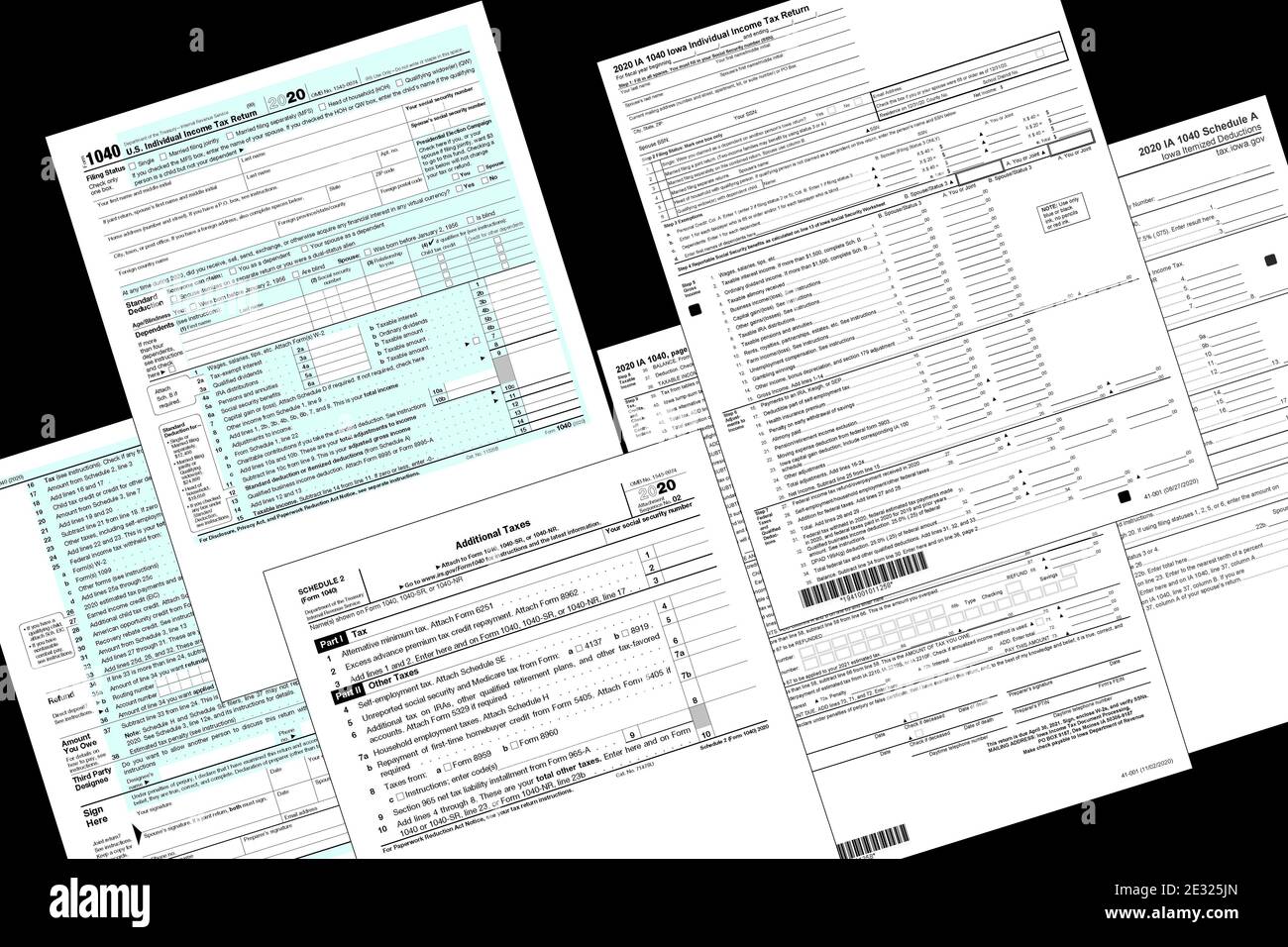

Tax Forms Hi Res Stock Photography And Images Alamy

Iowa State Back Taxes Understand Tax Relief Options And Consequences

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

Death Tax Definition Qualification Example How To Reduce

Federal Gift Tax Vs California Inheritance Tax

Iowa Power Of Attorney Form Ia 2848

Iowa Form 706 Fill Online Printable Fillable Blank Pdffiller